Amazon Seller News

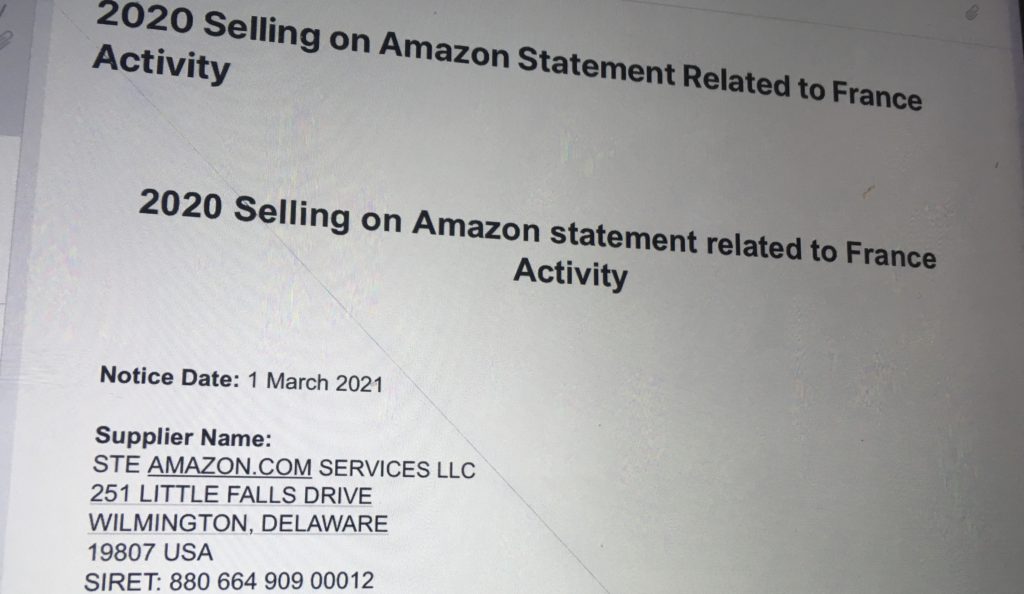

2020 Selling on Amazon Statement Related to France Activity

This week, Amazon Sellers across the globe started receiving e-mails sent by france-tax-regulation-compliance@amazon.fr regarding France sales even though they do not sell on any of the company’s European marketplaces.

In the notices, Amazon is referring to orders placed by French based customers on any international Amazon site, including Amazon USA or Japan, for example.

As long as you are meeting all tax thresholds, you don’t need to worry. Amazon is just informing you that they generated your data and provided them to French tax authorities on your behalf.

Here you can read a copy of the original e-mail notice sent to third party Amazon Sellers (by Amazon USA):

| 2020 Selling on Amazon statement related to France Activity Notice Date: 1 March 2021 Supplier Name: STE AMAZON.COM SERVICES LLC 251 LITTLE FALLS DRIVE WILMINGTON, DELAWARE 19807 USA SIRET: 880 664 909 00012 Hello, In accordance with the French Anti-Fraud Act (provisions of paragraph 3 of Article 242 bis of the General Tax Code), Amazon is required to provide you and the French Tax Authority details on your Selling on Amazon activity that is related to France. This information can be used to determine whether or not you have potential tax and social security obligations in France. The following are reportable activities associated with Selling on Amazon that are under the French Anti-Fraud Act: • Any transaction that is shipped to a French address • Any transaction that is shipped from a French address • All transactions if you are established in France, such as having a French Business Address Frequently asked questions Why am I receiving this statement? Amazon is required to report information to the French Tax Authorities if you meet any of the below criteria: • Ship to a French address • Shipped from a French address • Are established in France, such as having a French Business Address Am I required to take any action with this statement? Amazon is obligated to provide you with this statement annually. If you already meet your French tax and social security obligations, you do not need to take any further action. If you are not sure, we recommend that you reach out to your tax advisor to understand your obligations and take appropriate actions. Sellers on Amazon must comply with all applicable laws and regulations at all times. For more information, see the following French Tax Authorities’ websites: https://www.impots.gouv.fr/portail/ https://www.securite-sociale.fr/accueil How did Amazon determine what activity to report? Amazon uses the below information in your selling account to determine which transactions are reportable under the French Anti-Fraud Act: • Seller Address, such as place of establishment, legal, or business address • Seller default ship from location; • Ship from location, the Amazon Fulfillment Center shipping your product, and Ship to location. Important: It is the Sellers responsibility to keep their selling account information up to date. Will the French Tax Authorities contact me? As part of the French Anti-Fraud Act, Amazon is obligated to provide the French Tax Authority with your name, address, e-mail address, and tax identification number as it appears in your Selling on Amazon account. You can find the above information that Amazon reported on your Statement Related to France Activity. Amazon is required to provide this information to the French Tax Authority. The French Tax Authority may contact you at their discretion. Amazon is committed to helping sellers, but we cannot advise on your tax situation and are unaware if the French Tax Authorities will contact you. If you are contacted by the French Tax Authorities, Amazon recommends discussing with your tax or legal advisor. If you do not have a tax or legal advisor, we have created a list of third-party tax advisors as a resource. To learn more, see the Amazon Amazon.com Service Provider Network Help page. Amazon does not endorse the services of any tax advisor. What information is included in this statement? The statement contains a summary of Selling on Amazon activity reported under the French Anti-Fraud Act and the following information from your selling account: Supplier Name: The Amazon entity where the transaction occurred. Tax ID: EU VAT number, SIREN/SIRET, or US Employer Identification Number in your selling account. Declared Status: The legal entity or natural person operating in a professional capacity. Website: The Amazon marketplace where the transaction occurred. Currency Code: The three-letter code associated with the currency used in each marketplace. Sales: The total amount of sales. Refund: The total amount of refunds. Net Sales: The sales (including gift wrap, shipping, and promotions) minus refunds. Transaction: Any monetary change event, such as a sale, or refund related to France that includes the following:Ship to a French address Shipped from a French address Are established in France, such as having a French Business Address. Sample order number: 112-4165494-6343567 For your reference, the above order number is a sample of a transaction that meets the criteria for activity reported under the French Anti-Fraud Act. Important: Information in this document does not constitute tax, legal, or other professional advice and must not be used as such. If you have questions, please contact your tax, legal, or other professional advisor. Note: This email message was sent from a notification-only address that cannot accept incoming email. Please do not reply to this message. Privacy policy: Amazon.com Privacy Notice Email Tracking: FR_2020_880664909_163885 © 2006- 2020 Amazon.com, Inc. or its affiliates. All rights reserved. Amazon, Amazon.com, and the Amazon logo are registered trademarks of Amazon.com, Inc. or its affiliates. Amazon Services Europe S.à rl 38 avenue John F. Kennedy, L-1855 Luxembourg. |

At the end of the e-mail, there is a PDF file attachment containing filled information about your sales by Amazon, which were provided to the tax authorities on your behalf.

As long as you are within all French Tax thresholds, you don’t need to worry or take any actions.

➡️ If you are an Amazon Seller who needs help with any Amazon-related issues such as suspensions, listing blocks or is looking for professional assistance, please don’t hesitate to subscribe to my new OnlyFans page at: www.onlyfans.com/kikaangelic

Libby

March 9, 2021 at 6:16 am

If you wish for to increase your knowledge simply keep visiting this web site and be

updated with the newest news update posted here.

Charline

March 18, 2021 at 3:28 am

I am extremely impressed with your writing skills as well as with the layout on your blog.

Is this a paid theme or did you modify it yourself? Either

way keep up the excellent quality writing, it is rare to see a nice blog like

this one today.

froleprotrem

April 4, 2021 at 1:24 am

I like this website its a master peace ! Glad I found this on google .

zovre lioptor

June 21, 2021 at 1:25 pm

This is very interesting, You are a very skilled blogger. I’ve joined your feed and look forward to seeking more of your great post. Also, I’ve shared your website in my social networks!

zovrelioptor

July 4, 2021 at 12:31 am

Your place is valueble for me. Thanks!…

manhwaland

September 1, 2021 at 6:28 am

A round of applause for your blog post. Keep writing.

Pingback: Google